110246 set out as an Effective. In the case of people over 80 years of age health insurance is usually not available.

Getting Ready For Tax Season Tips For Doing Your Taxes With Ease Tax Preparation Tax Refund Tax Services

The taxpayer spouse or the minor child mustnt own residential accommodation at the place of the employment.

. Assessment Year You are an Individual HUF Yes No Interest income from. For provisions that nothing in amendment by section 11801 of Pub. Thus the deduction of upto 5 0000 is allowed even if money is spent on their treatment rather than on health insurance premium.

The deduction allowed for 8 years. This section summarizes the tax treatment of amounts you receive from traditional individual retirement arrangements IRAs employee pensions or annuities and disability pensions or annuities. 110 or under 410 111 120.

110246 effective May 22 2008 the date of enactment of Pub. Beginning June 1 2007 an additional sales use and casual excise tax equal to one percent is imposed on amounts taxable pursuant to this chapter except that this additional one percent tax does not apply to amounts taxed pursuant to Section 12-36-920A the tax on. 5 1990 for purposes of determining liability for tax for periods ending after Nov.

110 of 2010 Direct Taxes Code 2013. Income limitations for the lifetime learning credit were increased to help filers transition to the lifetime learning credit. Deduction Under Section 80TTA.

No deduction shall be allowed under this section for a contribution to an organization which conducts activities to which section 162e1 applies on matters of direct financial interest to the donors trade or business if a principal purpose of the contribution was to avoid Federal income tax by securing a deduction for such activities under. 101508 be construed to affect treatment of certain transactions occurring property acquired or items of income loss deduction or credit taken into account prior to Nov. Welfare Exclusion Act of 2014 or benefits provided by an educational program.

Income Tax Department Deduction under section 80D Income Tax Department Tax Tools Deduction under section 80D. 2022 Deduction Under Section 80D Assessment Year Status. 5 1990 see.

The amount of the standard deduction for a decedents final tax return is the same as it would have been had the. Your family falls in below-60 age group max deduction of. Section 80GG - Tax deductions on house rent paid.

Therefore a maximum deduction that you can claim under this section is upto 55000 assuming. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 repealed the tuition and fees deduction for tax years beginning after 2020. 110234 except as otherwise provided see section 4 of Pub.

Under Section 80GG you can claim a deduction for the house rent paid when House Rent AllowanceHRA is not received in salary. Additional sales use and casual excise tax imposed on certain items. 110 of 2010 Direct Taxes Code 2013.

Amendment of this section and repeal of Pub. Income Tax Department Deduction under section 80TTA Income Tax Department Tax Tools Deduction under. Amount of deduction.

What Is A Tax Deduction Tax Deductions Deduction Tax

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

5 Most Overlooked Rental Property Tax Deductions Accidental Rental

20 Biggest Business Tax Deductions Business Expense Small Business Bookkeeping Business Tax Deductions

Can College Books Be Claimed As A Tax Deduction

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Deduction From Salaries During The Financial Year 2021 22 Circular No 04 2022 Https Www Staffnews In 2022 03 In 2022 Tax Deductions Income Tax Deduction

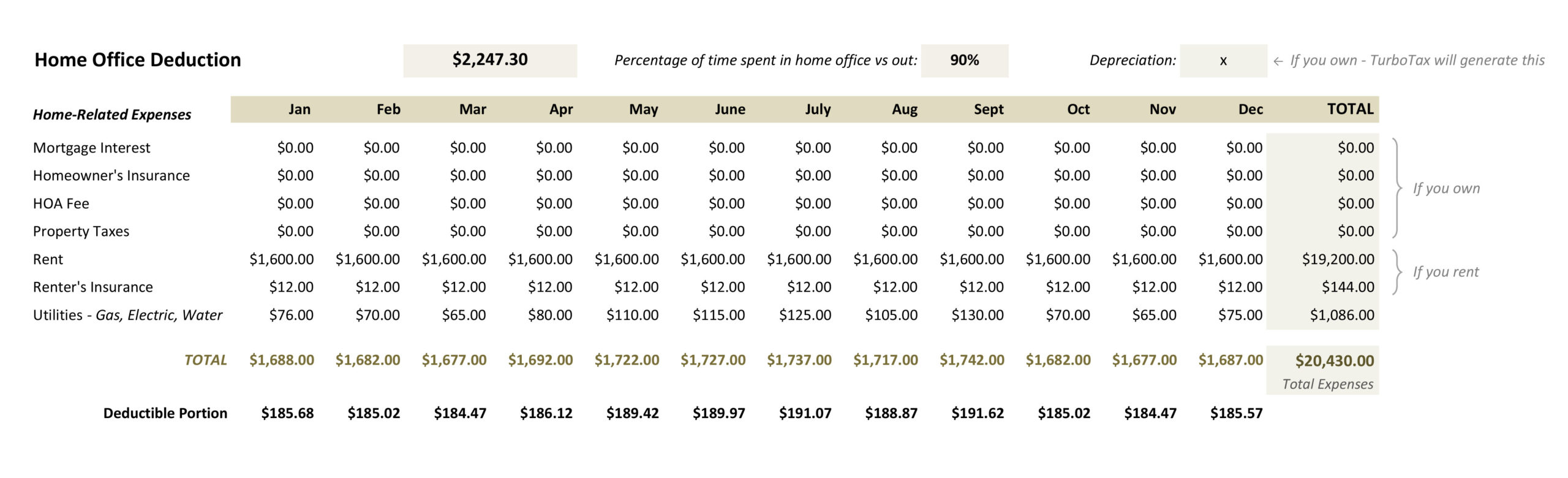

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Gilti Detailed Calculation Example

How Do Food Delivery Couriers Pay Taxes Get It Back

Employment Ka Matlab Kya Hota Hai Summit Employment 110 E Waterman Employment 74523 Equal Opportunit Small Business Tax Top Business Ideas Business Tax

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Cleartax In On Twitter Income Tax Budgeting Personal Finance

Meals Entertainment Deductions For 2021 2022

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

11 Deductions For Independent Insurance Agents Hurdlr

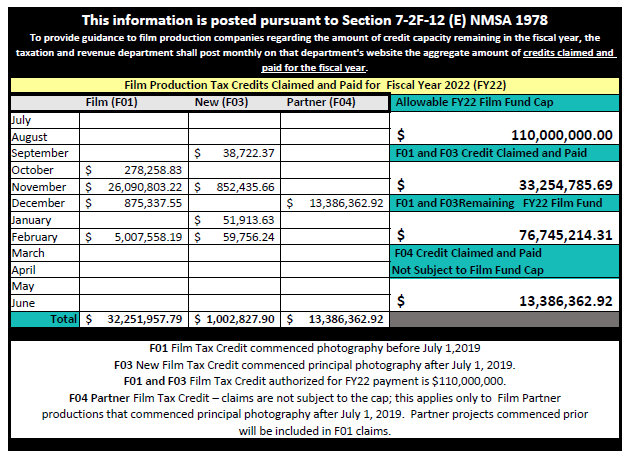

Film Production Tax Credit Tax Professionals